The tokenization of financial instruments onto public blockchains will reshape financial markets; much like the internet disrupted publishing, and cloud computing reshaped the enterprise.

I started my first fintech business in 2017 and since then have invested in, worked for, and advised over a dozen fintech and payments business in Canada, the US, and internationally.

In that time, payments companies like Stripe and Square have completely redefined the boundaries of traditional payments processing; Nubank has emerged as the largest retail “bank” in the world; and Visa has continued to re-imagine itself in a post-plastic world.

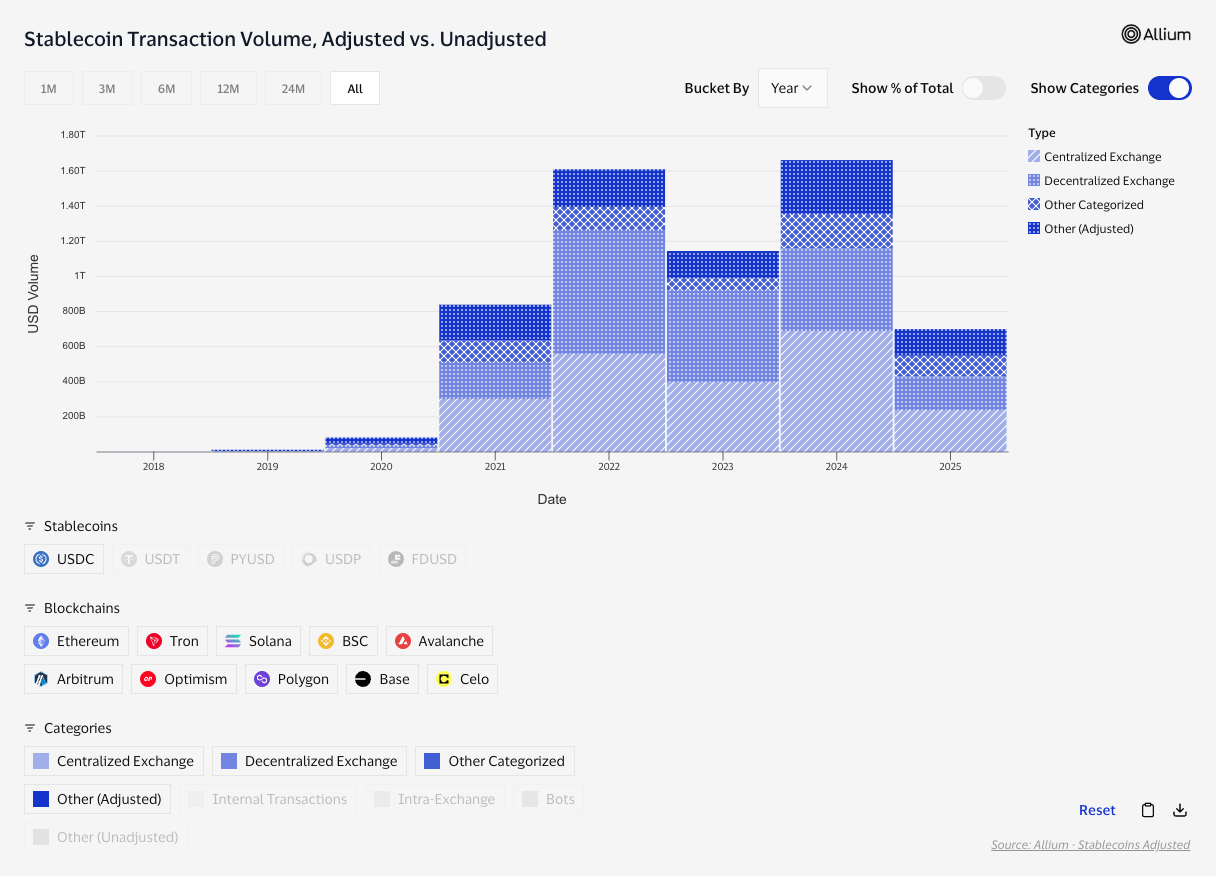

From 2020 to 2024, Stablecoin transaction volumes ballooned from $82b in to over $1.4t in 2024, driven largely by crypto industry use cases, but also by businesses and individuals seeking a faster, cheaper, and all around better way to send and receive money globally. The figures above are already adjusted to reflect “organic” payments.

Get in touch

You can find me at @jeremywblack, at my professional email (jeremy@kinvie.com) and at Avara (jeremy@avara.xyz).