Google Banking Follows the Travel Playbook

Google says they will never sell customer’s financial data, and I believe them. However, the only way Google’s checking account makes sense is if they use that customer data to sell you something or remove friction from a buying experience with one of their advertisers.

Here’s how they’ll do it.

Google’s strategy is to collect data on your income, debt servicing, and which card products you use.

Checking accounts store and move money. Customers don’t want to pay for them and banks can’t make money from them.

So why is Google offering checking accounts when Apple is offering credit cards? Scale. Google doesn’t want to offer checking accounts per se. Google wants to create a wedge and aggregate demand for all financial services.

Jeff Bezos is famous for betting on things that won’t change. Google is betting that providing a checking account is still the best way to sell additional financial products.

Act 1 – Lower the Cost of Customer Acquisition for Bank Partners

Google’s checking account doesn’t require a credit check and is available to anyone with a US tax ID. Google already has your name and address. It’s likely they have your date of birth. They may even have your tax ID.

With Google, banks get access to a huge number of prospective customers that can open an account in less than two minutes. In exchange, Google gets to aggregate an increasing amount of the demand for financial products.

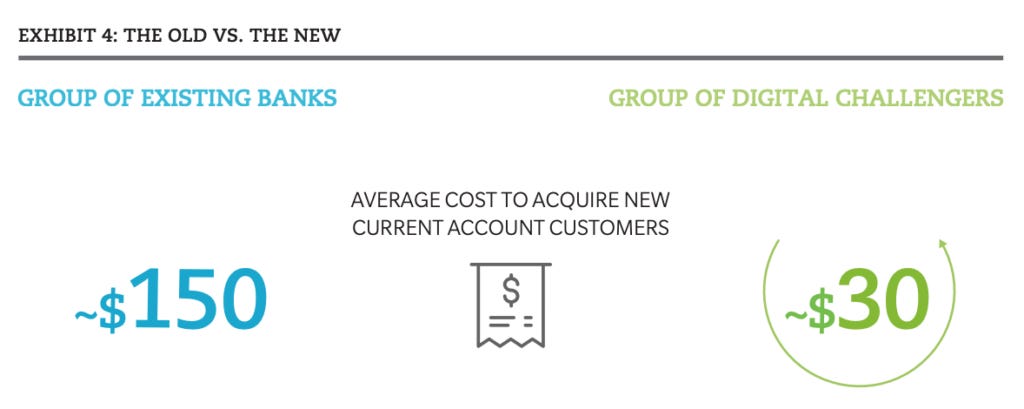

Banks pay an average of $150 to acquire a new checking account customer.

Google will help banks acquire new customers for less, while those banks service the customer just like any other.

Banks are losing the fight for the user experience layer; Plaid has made our bank data portable. Dwolla has enabled money movement from third-party apps; Neo-banks like Chime, Current, and Wave are acquiring customers with differentiated value propositions and more efficient distribution.

In many ways, partnering with Google leaves banks with more control (for now) than the alternative. Either way, the trend is the same; users want to access financial services from a variety of channels with no friction.

Here’s how the Google checking account will work: “Bank, take this information and open an account for this individual”. “Bank, show me the transactions on this account”. “Bank pay $2,000 to American Express.”…. and so on.

The infrastructure required for the bank to perform these operations is already built and paid for. The marginal cost of servicing the next customer is tiny compared to the cost of acquiring them. This is especially important because we’re talking about a product that no-one wants to pay for.

With this model, the bank serves the Google Checking Account customer no different than any other. The bank is still responsible for all compliance, card mailing, and customer service. Google accepts zero brand risk related to fees, security, user experience, or any of the other things that have made banks one of the most mistrusted industry groups in the World.

The banks now compete in a game that Google has designed.

Act 2 – Aggregate Demand

Booking.com spends $3.5B per year on Google’s advertising products. In 2018, Google booked $18B in ad revenue from the travel industry. Booking.com had revenues of $14.5B.

So what does this have to do with banking?

Financial services represent a small fraction of Google’s ad revenue. It makes sense; financial services are sold as new or expanding relationships. Travel is transactional.

The user controls all of the data required to perform a travel search and make a purchase. Not true for discovering and buying financial services.

But as banks lose control over the user experience, and customer’s financial data becomes more portable, financial services become financial products, and thus more transactional.

Earlier this year Skift explained why the Google Travel launch is the final piece of Google’s strategy to become the one-stop shop for travel.

Google’s bid to become the one-top shop for financial services may follow a similar path.

Act 3 – Google Pay

With a few exceptions, Google doesn’t process transactions as part of Travel. They mostly aggregate demand and pass the customer along to Booking.com, Expedia, and other online travel agencies.

If Act 3 for Google Travel is to process the transaction itself, let’s explore what Act 3 might look like for Google “Financial”.

In the future, there may be little functional difference between your Google Pay balance and your checking account balance or remaining credit. You don’t care where the money is stored so long as the source(s) of funds is applied to whatever purchase/transfer you’re making, in whatever priority makes the most sense.

When Google monitors your transactions and can access your sources of funds (checking account, credit cards, loans), Google Pay becomes the gateway to your finances.

Even truer if Google “sees” the transaction before anyone else. There are three parties that could “see” your transactions first:

A digital wallet like Google Pay

A card network like Mastercard

The bank (ie. automatic debit for your car or mortgage payment)

Digital wallet transactions will continue to grow. Google and others will continue to build information asymmetry vs. banks. Financial services will become more transactional. Google will become a one-stop-shop for financial products for millions of consumers.